Gold Card Visa Things To Know Before You Buy

Table of ContentsRumored Buzz on Gold Card Visa7 Simple Techniques For Gold Card VisaThe Facts About Gold Card Visa UncoveredThe smart Trick of Gold Card Visa That Nobody is Talking AboutThe Gold Card Visa Statements10 Simple Techniques For Gold Card VisaSome Known Factual Statements About Gold Card Visa

Significantly, these quotes only model local work development. Such models are not efficient in establishing whether a financial investment boosts accumulation, nationwide work. There is little solid, empirical proof that the EB-5 program as constructed today produces substantial task growth that would not occur without the program. Work development is certainly among the main advantages of Foreign Direct Investment (FDI), yet when the process takes virtually six years and still just generates speculative quotes of job development, it's time to consider options.

The smart Trick of Gold Card Visa That Nobody is Talking About

In this situation, the restricting element on the amount of earnings a Gold Card could generate is the variety of candidates ready to pay this taken care of cost. According to quotes from Knight Frank, a realty working as a consultant, there are about 1.4 million people living outside the United States with a total assets of a minimum of $10 million.

Congress needs to go better and excuse all CBP jobs from GSA's testimonial if it decides to use the Gold Card Visa profits for tasks at ports of access. Gold Card Visa financing can also be used to correct gaps in CBP staffing.

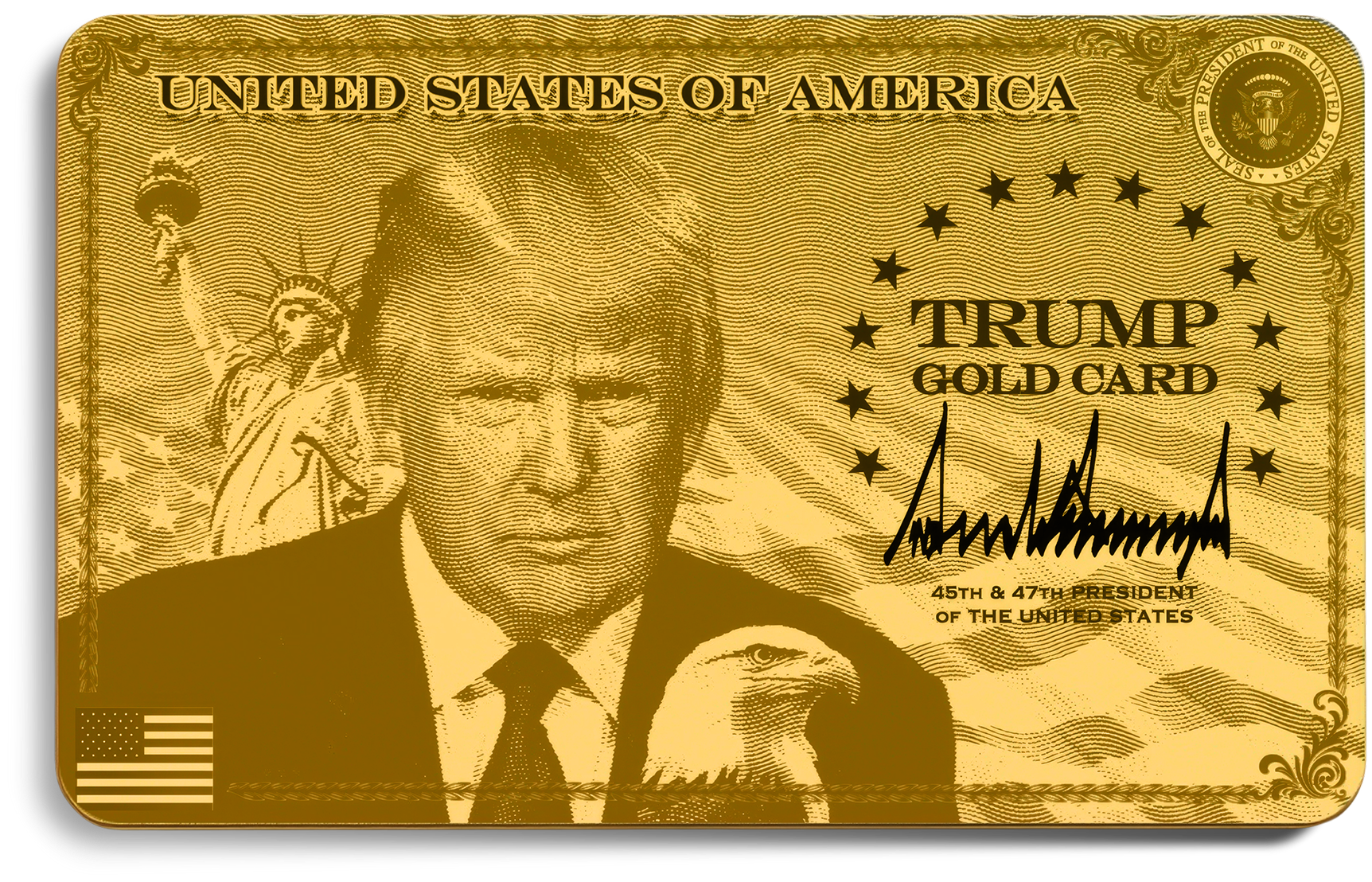

Today, Head Of State Donald J. Trump authorized an Exec Order to develop the Gold Card visa program, promoting expedited immigration for aliens who make significant monetary gifts to the United States. The Order guides the Secretary of Commerce, in coordination with the Secretaries of State and Homeland Protection, to establish a "Gold Card" program.

The Of Gold Card Visa

The Order instructs that these gifts work as proof of exceptional organization capacity and nationwide advantage, quickening adjudication regular with lawful and protection problems. The Order guides the Assistant of Business to transfer the gifts right into the Treasury and use them to advertise commerce and American market. The Order calls for the Secretaries to take all essential and ideal steps to apply the Gold Card program, including developing application procedures, fees, and potential growths to various other visa categories.

Head of state Trump is working non-stop to reverse the devastating plans of the Biden Administration to drive unmatched financial investments to America. Early in his second term, President Trump proposed Gold Cards, a vision he is now delivering to bring in rich investors and entrepreneurs. Head of state Trump's undeviating commitment to revitalizing American market has stimulated trillions of bucks in foreign financial investment promises.

Combined with the simultaneously-issued Presidential Pronouncement entitled "Restriction on Access of Particular Nonimmigrant Workers" on the H-1B Program needing employers to pay $100,000 per H-1B application (see Saul Ewing's summary here), there is much conjecture about the Gold Card Program. While the Gold Card Program has yet to be enacted, many concerns stay because of the issuance of the Executive Order.

The Single Strategy To Use For Gold Card Visa

revenue." The Gold Card and the Platinum Card therefore seem designed to operate within Congressionally-authorized visa procedures and do not, as anticipated, develop a new visa program that was not formerly approved by Congress. It is possible, however, that there will be challenges to the Gold Card Program questioning pertaining to whether Legislative intent in authorizing the EB-1 Program and the EB-2 Program is shown by the Exec blog here Order.

1153(b)( 5 )," which is the legal basis of the EB-5 Program. The Secretary of Business noted in an interview that the Gold Card Program can change the Variety Visa Program. Another factor that stays vague is whether private candidates can include their derivatives in the donation quantity; that is, does the called for contribution quantity ($1 million for the Gold Card and $5 million for the Platinum Card) relate to just the candidate or rather put on the candidate, as well as the candidate's partner and any of their kids under the age of 21? If the former, after that a family of four would need to give away $4 million for the Gold Card and $20 million for the Platinum Card.

This Source concern will require to be dealt with in any kind of last activity taken in codifying the Gold Card Program. One more vague topic associates with the vetting that would certainly be taken on under the Gold Card Program. Under the EB-5 Program, each applicant and, much more importantly, each applicant's source of funds, undertakes an extremely in-depth forensic analysis.

The Gold Card Visa Diaries

The IPO would certainly be the most sensible system to provide the Gold Card Program, provided its experience in providing the EB-5 Program; however, adding the burden of providing the Gold Card Program to the IPO would likely reduce adjudications for the EB-5 Program. An additional factor to consider associates with the tax treatment for applicants for the Gold Card and the Platinum Card.

on various other temporary visa categories, and who beware to stay clear of conference what is known as the "considerable existence" test. Because of this, the effort by the Administration seems to attract such people to spend in the united state by acquiring a Platinum Card. Exactly how the tax exception will certainly be accomplished without a modification of the U.S.

The Single Strategy To Use For Gold Card Visa

Ultimately, it is important to vital the Take into consideration's intentions in purposes with the Gold Card Program. Head of state Trump has actually long mentioned his desire to concentrate on alterations to legal migration visit this site right here and to permit investments to lower the public debt. It is also vital to consider that there is worldwide precedent for a two-tier program structure where one program concentrates on a "donation platform" while an additional concentrates on an "financial investment program".

The new program would certainly serve as means to please the "extraordinary capability" requirements of the existing EB-1 and EB-2 visa pathways for aliens with extraordinary or exceptional capacity. Additional advice is anticipated, as the EO also got the Secretary of Business, the Secretary of State and the Assistant of Homeland Safety and security to take all essential and proper steps to carry out the Gold Card within 90 days of the order.

irreversible citizens and people are currently based on united state tax obligations and reporting on their globally revenue. This means that united state irreversible homeowners and residents need to pay federal income taxes on income made outside the USA. The Management did, nevertheless, likewise mean a Platinum Card for a $5 million financial payment that would certainly "allow private applications to reside in the USA for as much as 270 days each year without being subject to tax on non-U.S.

people and permanent citizens, as these Platinum Card receivers would certainly have the ability to invest a bulk of their time in the USA without undergoing revenue taxes on their international revenue. This program is not yet readily available but is apparently in the works; Lutnick suggested that the program would need congressional authorization prior to they might formally release the $5 million-per-applicant program.